Kickstart and grow your business here.

Sign Up for FREE http://inoglo.com/Users/register

Kickstart and grow your business here.

Sign Up for FREE http://inoglo.com/Users/register

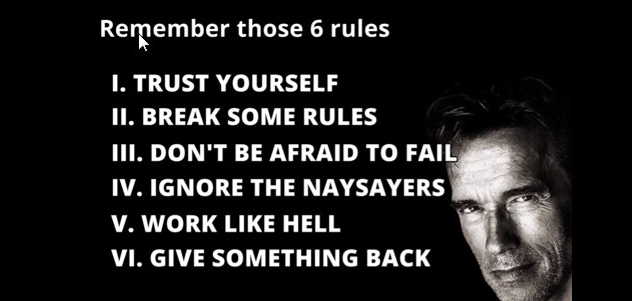

Remember this 6 rules..

Let success be one step closer with Inoglo

Sign up now for FREE http://inoglo.com/Users/register

Sign Up now for FREE http://inoglo.com/Users/register

We are here to support your needs! Here at Inoglo, you can find financing, loans, funding source, partners, investors, equipments sales, real estate for sale or lease and much more.

We are here to support your needs! Here at Inoglo, you can find financing, loans, funding source, partners, investors, equipments sales, real estate for sale or lease and much more.

☛ Sign up for FREE at http://inoglo.com/Users/register

HAPPY WEEKEND!

Starting a business is surprisingly simple–you just need to take the first step. Here’s how to get through the administrative hurdles faster than you think.

A neighbor had been talking about starting a business for at least six months. Whenever I saw him, that’s all he talked about. Eventually, I got tired of it.

“What the heck are you waiting for?” I finally asked.

It turns out, he thought the process of starting a business was really complicated. “I don’t want to go through all that stuff,” he said, “unless I’m absolutely sure my idea is perfect.” Like a lot of would-be entrepreneurs, he was stalling because he was intimidated by the apparent complexity of the administrative and legal tasks involved in starting a business.

So I bet him lunch that we could take care of all that in less than three hours.

Keep in mind, I’m only talking about setting yourself up to do business: I’m not talking about writing a business plan (although if that’s what you want to do, here’s a comprehensive guide to writing a business plan), sourcing financing, developing a marketing plan, etc.

The goal is to get off square one and get on to the fun stuff.

Here’s how:

1. Get over the company-name thing.

Many people agonize endlessly over dreaming up the perfect company name. Don’t. If you’re waiting until you come up with the perfect name, you’re also waiting to start making money.

Instead, at least for now, forget branding and unique selling propositions and all the business-identity stuff. And don’t worry about finding the perfect URL or website design or promotional literature. You’re putting those carts way before your business horse, too.

Just pick a name so you can get the administrative ball rolling.

Remember, your business can operate under a different name than your company name. (A “doing business as” form takes minutes to complete.) And you can change your company name later, if you like.

2. Get your Employer Identification number (EIN).

An EIN is the federal tax number used to identify your business. You don’t need an EIN unless you will have employees or plan to form a partnership, LLC, or corporation.

But even if you don’t need an EIN, get one anyway: It’s free, takes minutes, and you can keep your Social Security number private and reduce the chance of identity theft, because if you don’t have an EIN, your SSN identifies your business for tax purposes.

Note: If you’re using an online legal service to set up an LLC or corporation, don’t use it to get your EIN. Instead, apply online at the IRS website. You’ll have your EIN in minutes.

Now it’s time to head to your locality’s administrative offices.

3. Register your trade name.

If you won’t operate under your own name, your locality may require you to register a trade name. In most cases, you’ll get approved on the spot.

4. Get your business license.

Your county or city will require a business license. The form takes minutes to fill out. Use your EIN instead of your Social Security number to identify your business (for privacy reasons if nothing else).

You may be asked to estimate annual gross receipts. Do your best to estimate accurately, but don’t agonize over it. You’re just providing an estimate.

5. Complete a business personal-property tax form (if necessary).

Businesses are taxed on “personal” property, just like individuals. Where I live, no form is required for the year the business is established.

If you are required to file a business personal-property tax form and you plan to work from home using computers, tools, etc., that you already own, you won’t need to list those items.

If you purchase tangible personal property during your first year in business, you will list those items when you file your business personal-property tax form the following year.

6. Ask your locality about other permits.

Every locality has different requirements. In my area, for example, a “home occupation permit” is required to verify that a business based in a home meets zoning requirements.

Your locality may require other permits. Ask. They’ll tell you.

7. Get a certificate of resale (if necessary).

A certificate of resale, also known as a seller’s permit, allows you to collect state sales tax on products sold. (There is no sales tax on services.)

If you will sell products, you need a seller’s permit. Your state department of taxation’s websitehas complete details, forms, etc., if you decide to apply online, but most localities have forms you can complete while you’re at their administrative offices.

8. Get a business bank account.

One of the easiest ways to screw up your business accounting and possibly run afoul of the IRS is to commingle personal and business funds (and transactions). Using a business account for all business transactions eliminates that possibility.

Get a business account using your business name and EIN, and only use that account for all business-related deposits, withdrawals, and transactions.

Pick a bank or credit union that is convenient. Check out your local credit unions; often theyprovide better deals than banks.

9. Set up a simple accounting spreadsheet.

Worry about business accounting software like QuickBooks later. For now, just create a spreadsheet on which you can enter money you spend and money you receive.

Bookkeeping is simple, at least at first. All you need are Revenue and Expenses columns; you can add line items as you go.

Instead of spending hours playing with accounting software, dreaming up potential expense and income categories, and creating fancy reports with no data, spend that time generating revenue. As long as you record everything you do now, creating a more formal system later will be fairly easy. It will also be more fun, because then you’ll have real data to enter.

And now you’re an entrepreneur, with all the documents to prove it.

For many Americans, the thought of starting and owning a business is a lifelong dream. The sad fact, however, is that many of these dream businesses never materialize into anything more than just that—a dream. With a little preparation and research and a lot of hard work, you can turn your lifelong dream of business ownership into a reality.

Most successful businesses start as a passion, hobby, or skill of the owner. People work hardest and are most successful at things they love to do. With this in mind, choose a business that involves a specific passion, hobby, or skill of yours that will enable you to adequately perform the tasks related to your business on a day-to-day basis. Keep in mind that this business will be your life. You will be spending countless hours developing, building, and nurturing your business, especially in the beginning stages. Be sure to choose a business that will keep your interest and be fun for you to engage in.

After you have a reasonable, smart idea for your business, become an expert in that area. Check out books about your business area at the local library, do research online, subscribe to newsletters, and do everything else you can to gain further knowledge of your area.

You may also benefit from contacting established professionals in your line of business. Invite them to meetings and lunches and ask for their hints and tips. If you listen carefully, you can also get a sense of industry standards. Most professionals are happy to share their knowledge with newcomers. Remember, the more you know about your field, the more comfortable and successful you’ll be down the road.

Now that you have established a solid idea and gained some insight into your chosen field, it’s time to make your business a reality. Start by developing a specific business plan. There are tons of websites that publish templates and forms that you can use to draft your business plan.

Your business plan will serve as the official “map” of your company. It should set forth your goals, your intentions, the methods you will use to achieve those goals, the timeframe in which you expect to reach your proposed goals, and where you’d like to see your business headed in the future. Not only will a plan serve the operation of your business, but it’s also a requirement with some banks and financing institutions when applying for small business loans.

Almost all new businesses need help from outside sources. Whether it’s borrowing from a family member or applying for business financing from a bank, you will need funding for your initial stock of supplies and other necessities. Some business owners use their personal assets, savings accounts, or credit cards. Whatever method you use, make sure you gather enough capital to keep your business afloat until revenue starts rolling in.

Before starting your business, check the local, regional, state, and federal requirements for operating a business in your area. Obtain any necessary business licenses. Do your research and determine if a sole proprietorship is right for you or if you would be better off as an incorporation, a limited liability company, or another business entity. No matter what type you choose, thoroughly research the requirements for setting the entity up and be sure to file all the paperwork necessary to become legally established, such as articles, bylaws, EIN applications, etc. Check out LegalZoom’s business services for simple ways to complete these requirements.

Once you’ve established a legal business entity, it’s time to actively build the foundation of your business. No matter what industry or what stage your business is in, one thing is universal: You need good marketing to grow your business. You may want to purchase ad space or use other traditional marketing tactics as well, but the best advertisement is happy customers. A happy customer tells friends and family members about your valuable services, sending more potential customers your way.

Find hundreds of full or part time business ideas, partners, investors for FREE!!!

Visit our site and start growing!

Inventor and entrepreneur Stephen Key says that in order to earn unlimited income, you’re going to have to find a multiplying effect. Exponential — not gradual — income growth is your key to business success.

Find ways to be lazy by piggybacking on other opportunities, ideas or trends. This will allow you to keep your freedom to do what you want.

You can always decide to make more money, but you cannot choose to make more time. Time is your most valuable asset, and until you choose to treat it with value, it will continue to be worthless. Click to visit site

Yes.. It depends on you.

Join InoGlo now and let success be one step closer to you.

Sign up for FREE here –> http://inoglo.com/Users/login